FTX Bankruptcy Update: Proposed Settlement Reached in Embed Acquisition Case

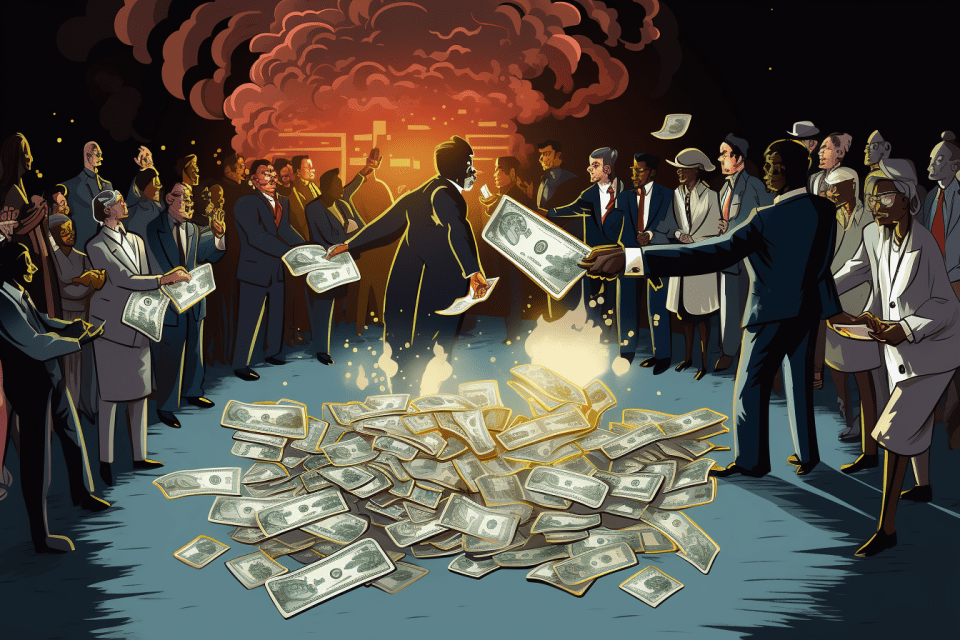

The ongoing saga of the FTX bankruptcy has taken a new turn with the latest developments involving the acquisition of the stock-clearing platform Embed. FTX debtors, grappling with the fallout of the crypto exchange’s collapse, have proposed a separate litigation settlement in the bankruptcy case, focusing specifically on this controversial acquisition.

At the heart of this dispute is the acquisition of Embed, a deal completed for $220 million in June 2022 by FTX’s U.S. arm. Notably, this acquisition was executed with minimal due diligence, as noted by FTX’s legal representatives. In a significant move, FTX debtors have reached a proposed settlement with former CEO Sam “SBF” Bankman-Fried. This settlement pertains exclusively to the claims against him in the Embed case, aiming to recover the full value conferred by the simple agreements for future equity (SAFEs) upon Bankman-Fried and ensuring he relinquishes all assets held in his name at Embed.

The details of the settlement include two SAFEs issued by FTX US to Bankman-Fried in 2022. These agreements necessitated Bankman-Fried to pay $160 million for rights to a number of shares in the crypto hedge fund. The proposed resolution ensures the return of all value from FTX US to which Bankman-Fried may be entitled.

It’s crucial to understand that this proposed agreement is limited in scope, addressing only specific aspects of the bankruptcy case related to Embed and Bankman-Fried. This agreement does not encompass all assets involved in the FTX bankruptcy proceedings. Following its filing for bankruptcy in November 2022, after Bankman-Fried’s resignation and subsequent conviction of felony charges, FTX has been actively managing creditor claims and consolidating assets, including a recent move to pool assets with its Bahamian arm, FTX Digital Markets.

Despite this settlement, FTX debtors continue to pursue other claims against the former CEO and executives. In May, FTX filed lawsuits in the U.S. Bankruptcy Court in Delaware against former insiders, including Bankman-Fried, Embed executives, and shareholders, seeking to reclaim over $240 million paid for Embed. The acquisition of Embed, completed just weeks before FTX’s collapse, is a focal point of controversy. FTX lost billions in customer funds, a situation its current CEO John Ray attributed to “old-fashioned embezzlement”.