The Tax Reform Proposal of Florida Governor Ron DeSantis in the 2024 Presidential Contest

In the race for the presidency in 2024, Florida Governor Ron DeSantis has put forward a significant tax reform proposal as a central component of his campaign. This proposal includes the removal of the Internal Revenue Service (IRS) and the establishment of a flat tax system. During a town hall meeting in Iowa, DeSantis expressed his desire to eliminate the IRS, stating that a flat income tax rate would stimulate economic development and address inefficiencies in the current tax system.

To support his proposition, DeSantis highlighted Florida’s history of low taxes and robust economic growth. Additionally, his strategy involves promoting The Fair Tax Act, a crucial legislation linked to tax reform.

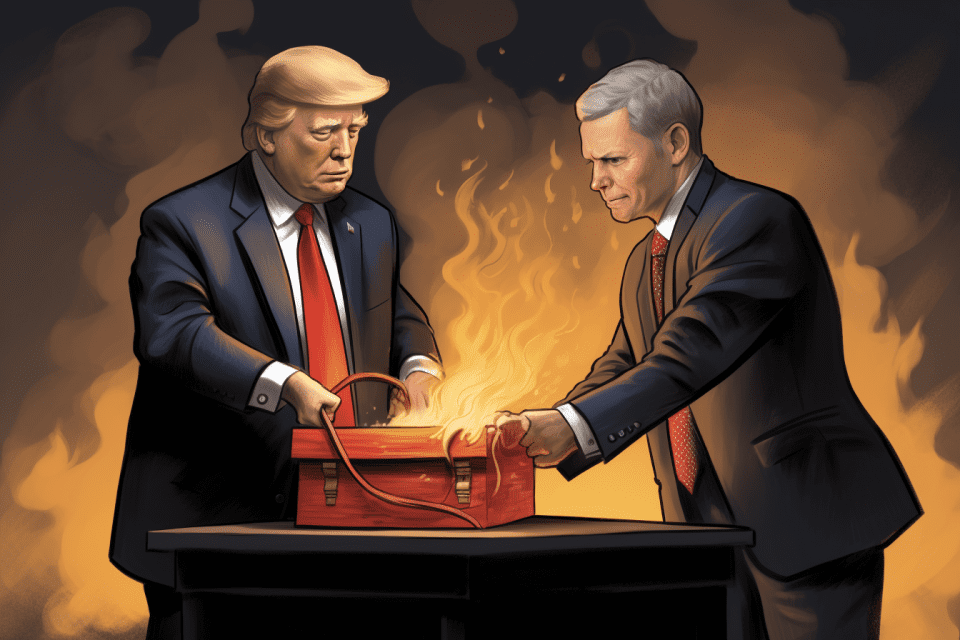

However, DeSantis’s support for the Fair Tax Act has sparked a significant conflict between him and former President Donald Trump. The Fair Tax Act aims to replace federal income, payroll, and inheritance taxes with a national sales tax rate of 23 percent. A commercial released by Trump’s Super PAC, MAGA Inc., criticized DeSantis for previously endorsing legislation that proposed a national sales tax. This intensified the political argument between the two figures.

In response, Never Back Down, a Super PAC affiliated with DeSantis, released a film showcasing Trump’s past support for the Fair Tax. This situation exemplifies the complex dynamics within the Republican party regarding tax policy. Both candidates were previously associated with the Fair Tax concept but are now positioning themselves differently in the political arena.

DeSantis’s tax reform plan, particularly his backing of a flat tax system and the abolition of the IRS, distinguishes him in the 2024 presidential contest. The discussion surrounding tax reform, specifically the Fair Tax Act, highlights the divergent viewpoints within the Republican party. This topic is expected to play a significant role in the upcoming election in April.

Image source: Shutterstock