Vanguard Faces Criticism for Excluding Bitcoin ETFs: A Shift in Investor Preferences

Vanguard’s Conservative Stance on Cryptocurrency

Vanguard, known for its traditional investment philosophy, has maintained a conservative approach towards cryptocurrency investments. This firm stance is aligned with the company’s long-standing policy of risk aversion and focus on generating real, positive long-term returns for investors. However, this decision has sparked considerable debate within the financial community, as it seems to overlook the burgeoning significance of decentralized monetary systems like Bitcoin.

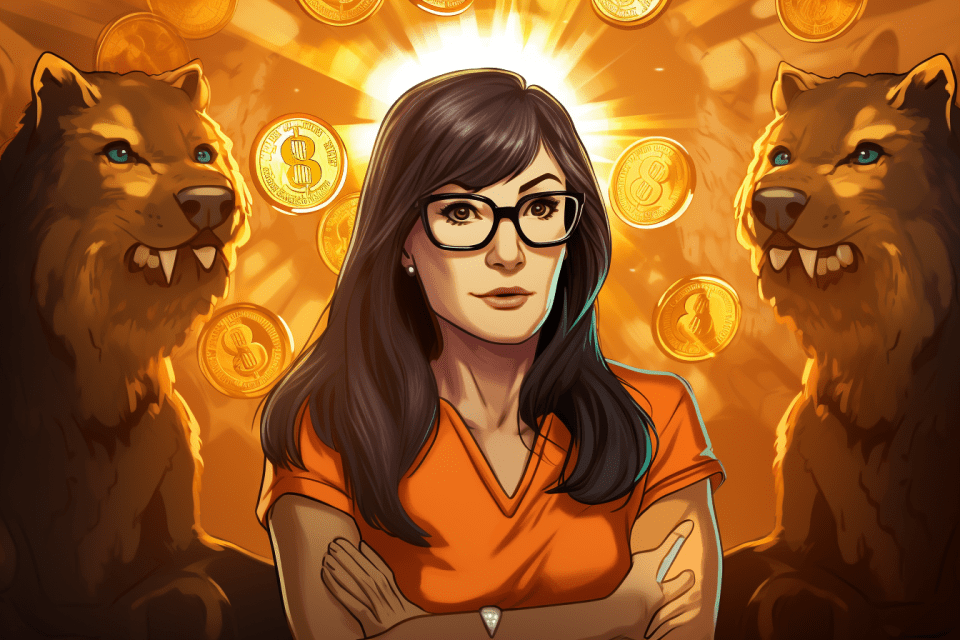

Cathie Wood’s Stance

Cathie Wood, CEO of Ark Invest and an advocate for disruptive technologies, has openly criticized Vanguard’s decision as a “terrible” move. In her view, it deprives investors of the opportunity to engage with a significant, decentralized monetary system like Bitcoin. Wood’s critique goes beyond mere opinion, highlighting a notable shift in customer behavior. Following Vanguard’s reaffirmation of its crypto-averse policy, a significant number of users began moving away from Vanguard to platforms offering Bitcoin ETFs. This customer shift underscores a growing demand for crypto-related investment products among modern investors.

The Social Media Backlash

Vanguard’s stance has triggered substantial backlash on various social media platforms, with movements like #BoycottVanguard gaining traction. This public dissatisfaction has extended beyond social media, with advocates for Bitcoin encouraging investors to transfer their assets to more crypto-friendly platforms. Given these developments, industry analysts suggest that Vanguard might eventually reconsider its position due to the changing market dynamics.

Ark Invest’s Strategic Moves and Optimism

Amid this backdrop, Ark Invest has been making strategic moves in the cryptocurrency space. The firm sold its holdings in the Grayscale Bitcoin Trust and invested heavily in the ProShares Bitcoin Strategy ETF. This shift reflects Ark Invest’s cautious yet forward-looking approach amid the current regulatory environment. Furthermore, Ark Invest has recently received approval from the U.S. Securities and Exchange Commission to launch a Bitcoin ETF, with an ambitious target of Bitcoin reaching a valuation of $1.5 million by 2030.

Conclusion

The controversy surrounding Vanguard’s decision to exclude Bitcoin ETFs highlights a pivotal moment in the investment world. As the landscape of investments continues to evolve with the increasing integration of digital assets, traditional investment giants like Vanguard may need to reassess their strategies. Meanwhile, firms like Ark Invest are embracing the transformative potential of cryptocurrencies, signaling a significant shift in the industry’s outlook towards these emerging financial technologies.

Image source: Shutterstock