South Korea Takes Steps to Regulate Crypto Mixers to Combat Money Laundering

South Korea is taking significant steps to regulate digital asset mixing services, known as crypto mixers, in response to increasing concerns over their use in money laundering activities. The Financial Intelligence Unit (FIU) of the Financial Services Commission, South Korea’s primary financial regulator, is spearheading this initiative, drawing inspiration from similar regulations recently implemented in the United States.

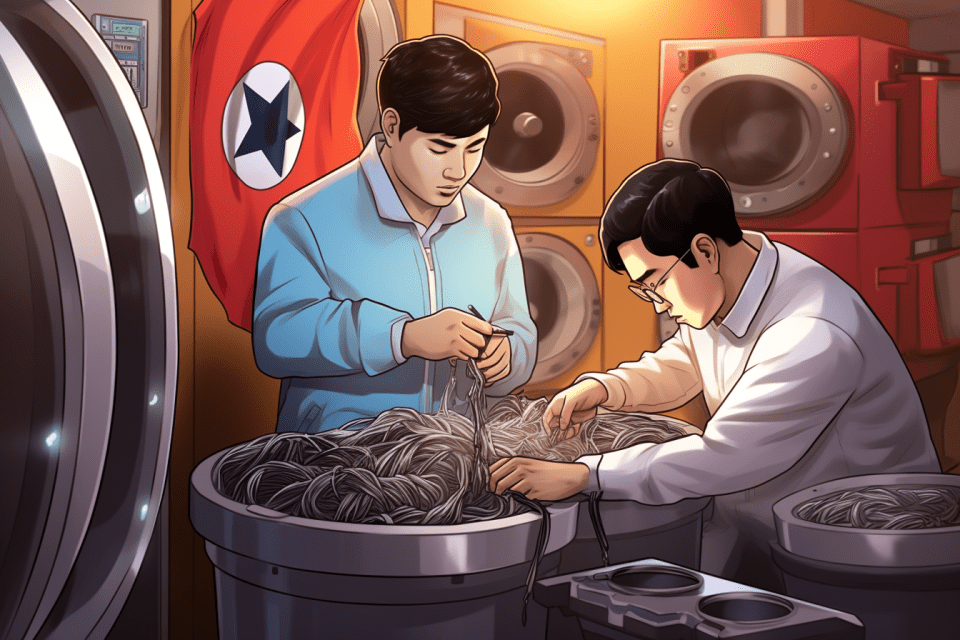

Crypto mixers have emerged as a prominent tool in the digital asset landscape, offering users the ability to obscure the origins of their cryptocurrency transactions. While initially designed to enhance privacy, these services have increasingly become associated with illicit activities, including laundering money obtained through criminal endeavors. The anonymity afforded by crypto mixers has made them attractive to various illegal organizations, prompting regulatory bodies to take action.

In August 2022, the U.S. Treasury Department set a precedent by announcing sanctions against Tornado Cash, a well-known crypto-mixing service, due to its role in laundering over $7 billion since 2019. This move was followed by further sanctions in November 2023 against another mixer, Sinbad, linked to North Korean activities. These actions by the U.S. government have highlighted the urgency of regulating such services to prevent their misuse.

The South Korean FIU’s decision to regulate crypto mixers aligns with a broader global trend of tightening controls over digital financial transactions to combat money laundering. According to an FIU official, the discussions in South Korea began following the U.S. sanctions and are still in the early stages. The official noted the importance of global cooperation in addressing the challenges posed by crypto mixers, emphasizing that the issue transcends national boundaries.

South Korea’s proactive stance in this regard reflects its recognition of the potential risks posed by unregulated digital assets. The country has been a leader in technological innovation and has a substantial digital asset market. However, recent incidents, such as the $81 million hacking of Ozis, a domestic blockchain company, have underscored the vulnerabilities inherent in the current system.

The new regulations are expected to balance the need for innovation in the digital asset space with the imperative to protect the financial system from exploitation by criminal elements. These measures will likely include stringent monitoring and reporting requirements for virtual asset service providers, especially those offering mixing services. The Korean government aims to ensure that while fostering the growth of the blockchain and cryptocurrency sectors, adequate safeguards are in place to prevent their misuse for illegal activities.

This development in South Korea is part of a growing trend where countries are increasingly recognizing the need to regulate the digital asset space to prevent financial crimes. As the digital asset market continues to evolve, we can expect more nations to introduce similar regulations, shaping a more secure and transparent global cryptocurrency landscape.